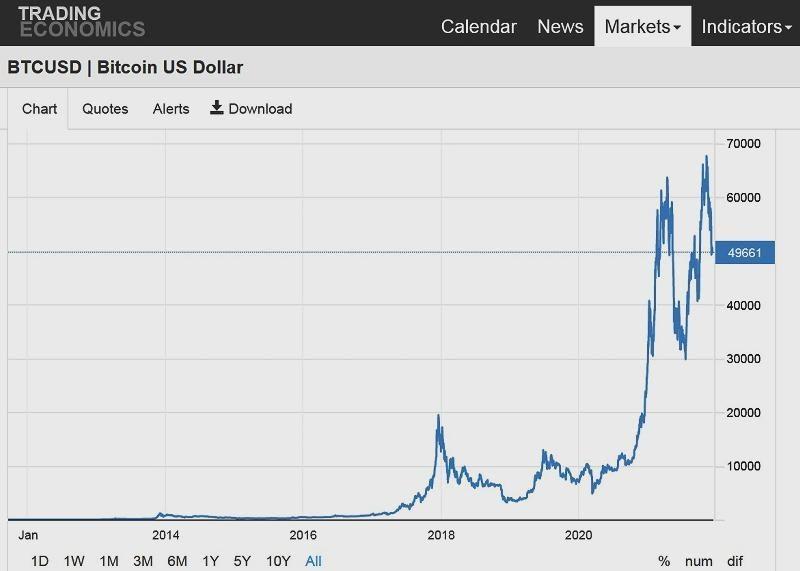

Bitcoin prices plummeted on 4th December. In one weekend it fell to only 60% of its peak 10th November value.

Are you glad you didn’t have a biscuit tin of bitcoin at home?

Is this the end?

No. We all know how volatile crypto prices are and this kind of price crash has happened before. Previous crashes have been followed by price increases that more than made up for the losses. After the 2018 crash, it did take three years, but prices have always recovered in the past.

Crypto is the Future

Cryptocurrencies are not supervised by national banks such as the Bank of Ghana (BOG). Trading is not licensed by the BOG and if you are scammed or otherwise lose your money, you have no comeback.

The e-Cedi is coming. The BOG is testing a new national cryptocurrency, but it will be a few years yet before the e-Cedi goes mainstream.

Why Should You Buy Crypto in Ghana?

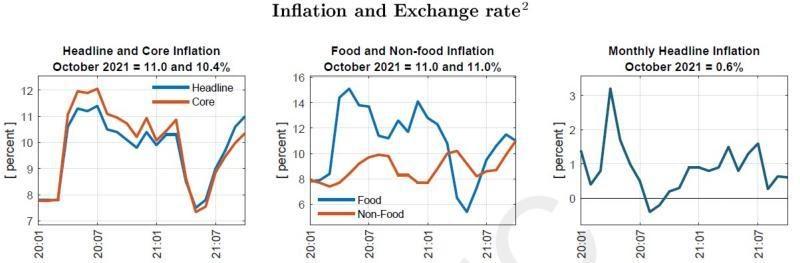

In one word, inflation.

Inflation happens when central banks print more money.

Inflation is like a hole in your pocket. Every day the cedi in your wallet buys less. Inflation might be lower than it was a few years ago, but that is little comfort when you have increasing bills to pay each month.

Digital currencies are not controlled by politicians or central banks. Nobody can decide to release more coins in response to an economic or political crisis. Cryptocurrencies are seen as inflation-proof.

Crypto Today

Do you have to wait for the e-Cedi? No.

It is perfectly legal to buy Bitcoin, Ether, or any other digital currency in Ghana. To minimise risk, you should avoid new cryptocurrencies because the risk of fraud is higher there.

In the past, crypto values have trended upwards. It has not been a smooth curve, and values could crash at any time. If you buy when values are high, your coins may be less valuable in the short term, but in a few years, they might be worth more. Nobody can say the same for the cedi, dollar, or pound – They will definitely be worth less every year.

Crypto Investing

Crypto investors buy coins and aim to keep them. It is better to buy when prices are depressed after a crash. Sadly, many people buy when they see headlines of record values when price falls are more likely before the upward trend restarts. You don’t need $47,000 to buy a whole bitcoin. You can buy tiny fractions of coins. All you need is a digital wallet to keep them in. A wallet is a kind of crypto account where you store all your coins.

Crypto Trading

Crypto traders buy coins and sell them the same day. They may only hold them for a few minutes or hours, never even overnight.

Anyone in Ghana can try crypto trading. All you need is a few hundred cedis, a phone or computer, and an internet connection.

Many crypto traders never own any coins. They aim to make money using CFDs (Contracts for Difference). When you take out a CFD you predict whether the crypto will go up or down. If your prediction is correct, you can make a profit (there are costs and charges to take into account). If your prediction is wrong you make a loss.

A reputable crypto platform will encourage you to limit your potential loss using a ‘stop-loss’ option.

CFDs let you profit even when crypto prices are falling, if you predict the fall correctly.

Indirect Crypto Investing

You can buy shares of companies that hold large amounts of cryptocurrency (Tesla stands out here.), or you can buy stocks that are involved with blockchain and crypto technology.

If you go this route you risk everything if you only hold one or two stocks.

Blockchain ETFs (Exchange traded funds) are another alternative for the investor with limited funds. The ETF holds shares in blockchain-related companies, so when you buy ETF shares you own a small part of those assets and your risk is less than it would be if you only hold a few stocks directly.

Over to You

Cryptocurrencies are volatile and values go down as well as up.

Should you buy crypto coins? Perhaps. With prices lower than they were a few weeks ago it could make sense to buy now rather than when prices reach their next peak. However, you should be prepared to tie up your investment for at least a few years, and you could still lose money if the price falls further.

CFDs are offer you another way to get into crypto, but CFDs have their own risks, and require a lot of research before you start trading.

ETFs are another option if you want exposure to crypto price growth but your funds are limited.