M-PESA Guide: How to Send and Receive money from Kenya

M-PESA is a mobile banking wallet that allows users to send and receive money from various platforms and users all over the world. When compared to conventional banking, M-PESA enables you to obtain your money immediately without having to pay high transaction fees.

Since its start on March 6, 2007, like M-PESA, Kenya’s main telecommunications company, Safaricom, has managed the money-transfer platform.

M-PESA is available in Ethiopia, Rwanda, Uganda, Tanzania, the Democratic Republic of Congo, Mozambique, Lesotho, Afghanistan, South Africa, and Egypt.

M-Pesa uses text messaging to make deposits and receive payments to individuals and companies. The service has become Africa’s biggest fintech platform, with more than 49.7 million individuals utilizing the program as of 2022. Mpesa’s biggest feature is its simplicity since it is quite handy.

To utilize the service, you don’t need a bank account. All you need is a functional smartphone that can use M-Pesa services like sending and receiving money, filling up airtime, paying bills, and borrowing money quickly using M-Shwari.

What is M-PESA, and how can I use it?

To utilize any M-PESA services, you must first check a valid Safaricom phone number. You will be asked to provide a four-digit number upon registration, which will be needed throughout all transactions.

If everything goes properly, Safaricom will give you an M-PESA confirmation message stating whether the transaction was successful or not. You can access Send Money, Withdraw cash, Buy airtime, Loans and savings, Lipa Na M-PESA, and My account from the M-PESA menu.

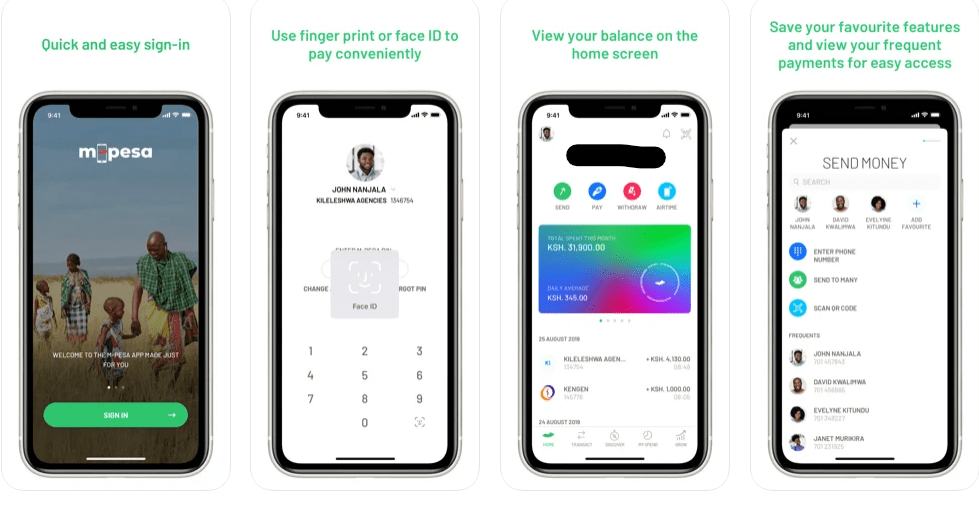

Safaricom also provides two apps, M-PESA Super App and M-PESA for Business Applications, that allow clients to use their services at any time. The apps are available in both the Google Play Store and the Apple Store for iPhone users. These apps provide more features than standard Safraicom STKs, which have yet to be seen on any new phones. It is possible to use the app without using data or WIFI, hide your balance, transfer money to several individuals at once, examine your spending history, and, most significantly, hide your balance. On top of your M-PESA PINs, you may use face unlock or fingerprint to validate a transaction.

What is the best way to transfer money from Western Union to M-Pesa?

Safaricom also offers the M-PESA worldwide service, which enables registered M-PESA customers to send and receive money anywhere over the world. To take advantage of this, you must be a Western Union member.

You may transfer any amount up to a maximum of 70,000 Kenyan shillings (614 USD), with a minimum of Ksh 101. (0.89 USD). A transaction of up to Sh 5,000 will cost you a minimum of Sh 100 while remitting more than Sh 35,000 will cost you a minimum of Sh 500. The following is how it works:

- Call *840# and follow the instructions, or

- Log in to your Western Union account and choose to Get started from the drop-down menu.

- Select the nation of the person to whom you wish to donate money.

- Put the amount of money you wish to send.

- Choose a Mobile wallet as the method you wish the money to be sent to the interested party.

- Fill in the information for your payment method.

- You and the other party will get a transaction confirmation message when everything is in order.

What is the best way to transfer money from M-Pesa to Western Union?

Assume you’re in Kenya and want to transfer money to a buddy who lives in another country.

- Dial *840# once again and follow the prompts.

- Select Lipa Na M-Pesa from M-Pesa.

- Select Pay Bill and input the 255255 company number.

- Enter the recipient’s mobile phone number as the account number, beginning with the country code.

- Enter the money, M-Pesa PIN, and transaction confirmation.

The new M-PESA app may now be used to transfer and receive money for international users:

- Safaricom’s M-PESA application may be downloaded here.

- M-PESA Global is the option to choose.

- Terms and conditions must be accepted.

- Select Send to opt-in.

How to use the Mpesa app to transfer money to another number in Kenya

- Download the Mpesa app

- Tap on send and request

- A list of options will be presented to you; choose the options that suit you well

- Enter the amount you want to send

- Tap on send and confirm your details once more

- An SMS should be sent to your mobile number to confirm the transaction

How do you deposit and withdraw money from your M-PESA account in Kenya?

This may be accomplished in two ways. If you know your account number and your bank’s Pay bill number, you may choose to pay money straight from your bank account to M-PESA.

The alternative method is going to the closest M-PESA agent in your area. Carry your national identity card with you at all times since you may be requested to verify your information. Safaricom will always send you an SMS verifying the transaction after money is put or deducted from your M-PESA number.

What exactly is the M-PESA statement, and how do I activate it?

M-PESA statement enables you to keep track of your spending and transactions. In the long run, they may assist you in determining where you manage your finances during a given period. The Mini and Full M-Pesa statements are the only two kinds of M-Pesa statements offered by Safaricom to its customers.

To sign up for this service, click here. Select My Account, Select M-PESA Statement, Select Register for Email Statement, Accept Terms and Conditions, Enter your email address, and validate your request with your M-PESA PIN by dialing *334#. A confirmation message will be sent to you, as normal, confirming that your registration request has been received and is being processed.

Conclusion

M-Pesa is not just Kenya’s but also Africa’s biggest fintech company. More than a million customers have profited from this service since Mpesa allows users to send and receive money not just in Kenya but also throughout the world. Furthermore, the platform is more secure and user-friendly.