How to get Mobile Money Loans In Ghana; GHS 1,000 in 1 minute

Getting access to a quick loan in Ghana these days is simple, easy, and less time-consuming. With the introduction of mobile money services and the advancement in security and cybercrime checks, many companies today don’t require collateral before even granting a loan to their customers.

Today, anyone can have access to a quick loan right from their account. The good part is that MTN, which is one of the leading players in the mobile money service here in Ghana has made viable partnerships so the masses can access loan facilities..

You can now easily get a loan from your mobile network provider depending on your credit risk. Apart from the MTN Qwik loan which is one of the popular mobile money loans out, there are other ways to obtain loans right from your mobile account and this article is going to cover that.

We will show you how to get access to mobile money loans in Ghana and also tell you other types of loans you can apply for. So without wasting further time, let’s nail the bot to the ground.

MTN Qwik Loan

Many of you might have already heard of the MTN Qwik Loan since is one of the most common types of mobile money loans in Ghana. The MTN Qwik loan is an initiative by afb Ghana and MTN Mobile Money providers to offer quick to subscribers of MTN mobile money service.

It’s a short-term, unsecured, cash loan paid into a subscriber’s MTN Mobile Money wallet. As far as you are a subscriber of the MTN MoMo, you can get access to the loan anytime and anywhere you want. At the initial stage, you may have a limit to the loan.

Thus, the providers can only give you the loan base on your MoMo transactions and also your commitment to the service. If you pay your loan on time, then your loan limit will be lifted and you can demand a loan of up to GHS 1,000 from this institution.

Of course, the loan comes with interest. Meaning when paying back your loan, you pay with an additional charge. So if you are ready to get the loan from MTN, you can follow the below steps.

As usual, you must be an MTN mobile money subscriber before continuing to demand the loan because it can only be granted using the service.

- Dial *170#

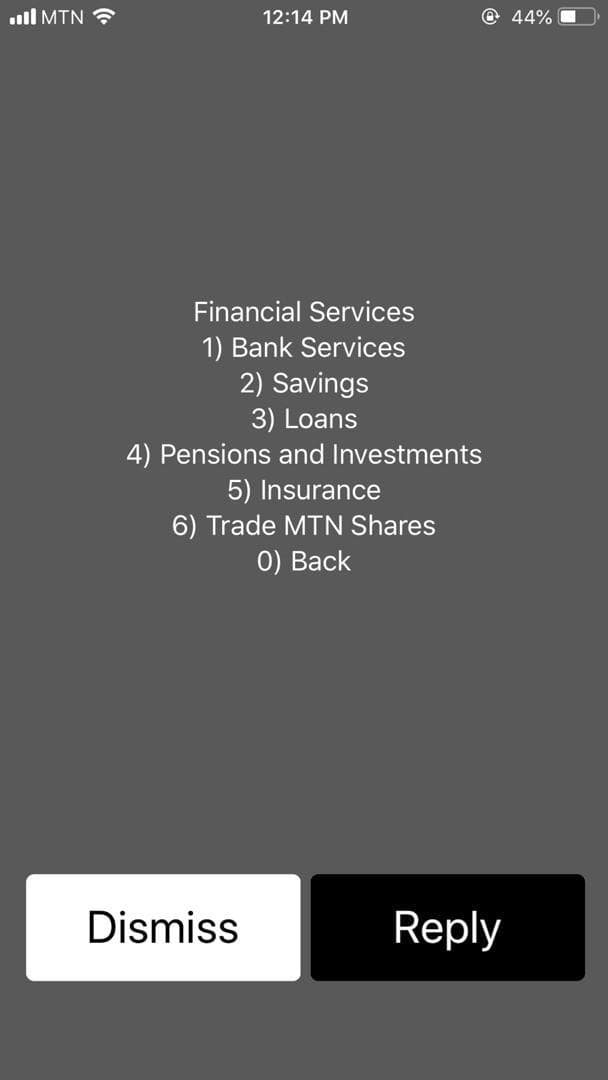

- Select option 5 that’s, financial service pic

![]()

- Select option 3 for loan

- Select option 1to register for the loan

![]()

- Enter your mobile money pin for confirmation

- Wait for confirmation

- You will get an SMS once your application has been approved.

That’s all, you have successfully gotten the loan now you can withdraw the money from an MTN Mobile merchant or you can withdraw your mobile money at an ATM. But make sure you pay back in time and stand the chance of getting more from MTN.

Fido Loan

Another way to get a mobile money loan in Ghana is through the FIDO loan lending institution. FIDO Money Lending Limited (FIDO) is a financial institution based in Accra, licensed by the Bank of Ghana.

The institution provides fast and easy short-term loans, called FIDO Loans to its customers. To have access to the loan, you will need to pass through a one-time verification of your ID and Mobile Money account.

Just Like the MTN MoMo Qwik loan, FIDO does not also require collateral or guarantors before giving you the loan.

How Does Fido Loan Work?

- Download the Fido App on the Google Play store for free

- Apply by filling out the loan application in the app

- Receive your money instantly

- Repay on time and get a higher amount for your next loan

NB: You can get up to 200 GHS on your first loan application. Once you pay on time then you unlock the initial limit and now you can apply to be given up to 600 GHS.

Smartcash

As mentioned earlier, the MTN Qwik loan was in partnership with the AFB financial institution offering the loan to its subscribers. The smartcash loan is also another type of loan by afb.

This financial institution was formed in the year 2010 and since then, they have grown to cover a large portion of Ghana’s financial sector. They offer different types of loans including the Qwik loan, Smartcash loan, and the payroll loan.

The smartcash is a short-term loan of up to 30 days, with an easy to understand terms. Applicants can receive the cash within 24 hours of application and this loan also does not require security, collateral or a bank account.

The cash is paid directly to your mobile account or you can visit any of their nationwide branch for the loan. Visit their homepage for more information and also for the application portal.

MTN XpressLoan

Xpress Loan is a borrowing or credit service on the MTN Mobile Money platform that allows regular MoMo subscribers to access a loan/credit facility through their mobile phone in a few minutes.

Existing MTN Customers can use the loan service to access loans. There is no need for savings or paperwork and the money is sent directly into the subscriber/applicant’s MoMo account.

How to borrow money from MTN XpressLoan

To borrow money from XpressLoan, follow the following steps on your phone:

- Dial *170#

- Enter option 5 (Financial services)

- Enter option 3 (Loans)

- Enter option 2 ( XpressLoan)

- Enter option 1 (Get a loan)

- Enter your Mobile Money pin and hit submit

- Enter option one ( View offers)

- Enter the option for your preferred amount (There are usually options available between GHS 50 and GHS 1000)

- Enter option 1 to confirm your repayment plan

Alright, the above mentioned are some of the mobile money or quick loan apps in Ghana that you can apply for today.

You should give any of them a try if you need a loan. Please let us know in the comment if you have any mobile money loan providers in Ghana that you think should also be listed but we’ve not listed here.