Since the introduction of mobile money in Ghana, some ten years ago, payments and other financial transactions have become faster and easier.

Today, we can make and receive all forms of payments from the comfort of our homes without any trouble.

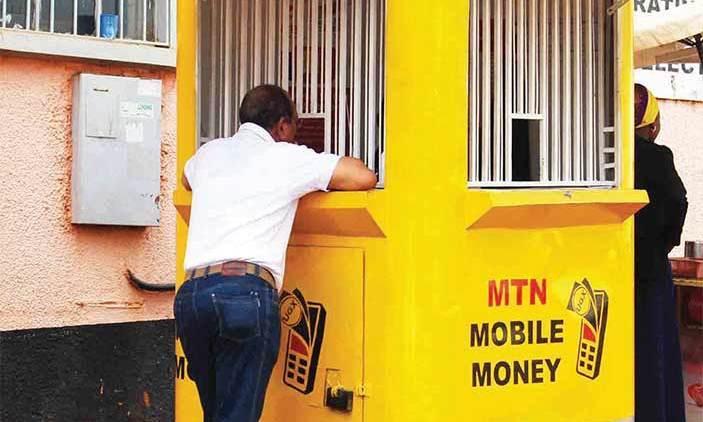

Indeed, mobile money and most especially MTN Mobile money has been a lifesaver for the majority of us.

However, the major challenge that comes with using mobile money in Ghana is the daily increase in mobile money frauds.

The activities of fraudsters have not just made mobile money difficult to use but also it has put lots of people in miserable situations and has also caused the loss of some lives.

In this article, we focus on some of the precautionary measures you should take in protecting your MTN Mobile money from these scavenging fraudsters.

Change Your PIN CODE As Regularly As Possible

Whereas the mobile money platform itself is highly secured and requires some difficult levels of hacking to break through – thanks to MTN’s security systems, one of the main things an individual can do to protect his or her mobile money wallet is changing PIN CODE from time to time.

Your Pincode is the key to your mobile money wallet. If someone has access to your PINCODE, they may be able to withdraw money from your account. It is, therefore, necessary that from time to time you change your PINCODE. Especially when you suspect that someone might have seen your PIN. It is also advisable for you to change your PIN CODE every 3 months.

Do Not Approve Transactions You Are Not Aware Of

One way people can play on your intelligence and steal money from your mobile money account is when they send a withdrawal request to your mobile device. Once you approve such transactions, the money is automatically deducted from your account and sent to the one who requested the payment.

The only things someone needs for them to be able to send such requests are your number and a merchant Simcard. You can imagine how easy it is for them to get these so you do not need to take a chance at all.

When you get notification for any transaction you did not initiate, kindly cancel it and report to your service provider.

Avoid Filling Forms Online For Free Data And Airtime

One way people get access to your phone number is true such fake links usually on WhatsApp requiring that you fill some forms so you get some amount of data or airtime in exchange.

Most times, such links request that you input your phone number and other personal details.

These pieces of information are stored on such websites and retrieved by the owners who may then use your number to defraud you.

Always Check Your Balance To Confirm Any Mobile Money Transaction

One thing that remains for sure is that apart from you or anyone else who uses your phone, nobody knows the amount of money you have in your mobile money wallet.

With that said, it’ll be difficult for fraudsters to realise the exact amount of money you have in your account and frame a fake Mobile Money message to reflect that amount.

Therefore, it is important for you to always check your balance whenever you receive any new message regarding cash received. If the amount stated in the message is different from the amount in your account, know that you’ve just been saved from a possible scam.

Conclusion

The points listed and discussed above are just some ways through which you can protect your wallet from fraudsters.

There may be a hundred other ways to do so but based on our experiences with MTN Mobile money and fraudulent activities associated with it, these are our top ways of protecting an MTN Mobile money account. If you have any reservations, enquiries or comments regarding this post, kindly leave it in the comment box below.

For the past two months when ever I ppply through the process after the option 3 which is the loans they tell me transactions failed till Date am not able to access the loan why