The Government of Ghana has made a new directive regarding taxpayers and as it is, we must follow it.

This is because, it will become increasingly difficult to get some services and cards – like the Ghana Card without a Tax Identification Number (TIN Number).

Recently, the COVID-19 relief fund by the Government of Ghana mentions the TIN as a requirement.

The government has directed that every Ghanaian who is required to pay tax, or could be paying tax in the near future, must get their own Tax Identification Number (TIN).

Ghana Online Tax Identification Number (TIN) Updates

01-Jan-2020: The online process for applying for the Ghana TIN is back active and all Ghanaians can now use it to get their temporary credentials and the TIN in a week.

What is Tax Identification Number?

The Tax Identification Number (TIN or “TIN Number”) is a unique Identification Number issued to taxpayers for official transactions. In Ghana, apart from Paying taxes, TIN is used for other services like importing goods into the country and registering a business or land.

A Tax Identification Number (TIN) is required for official transactions with the following public institutions:

- The Domestic Tax Revenue Division of the Ghana Revenue Authority

- The Customs Division of the Ghana Revenue Authority

- The Controller and Accountant General’s Department

- The Registrar General’s Department

- District Assemblies and

- Any Public Institution which the Minister may by legislative Instrument prescribe.

Who can apply for a Tax Identification Number in Ghana?

According to the GRA, the following people are required to register for a Tax Identification Number:

- Earns taxable income in Ghana

- Wishes to clear goods in commercial quantities from any port or factory

- Wishes to register a title or other documentation relating to land

- Requires a Tax Clearance Certificate

- Wishes to register a business/company at the Registrar-Generals Department

- Requires a Permit from a District Assembly

- Intends to receive a payment from the Controller and Accountant-Generals Department

Uses of Tax Identification Number (TIN) in Ghana

Here in Ghana, the Tax Identification Number is becoming increasingly important due to the numerous services it is required for, with new ones being added regularly. Here are some of the services you would need to use your TIN for in Ghana

- to clear any goods in commercial quantities from any port or factory

- to register any title to land, interest in land or any document affecting land

- to obtain any Tax Clearance Certificate from the Internal Revenue Service, Customs Excise and Preventive Service or the Value Added Tax Service.

- to obtain a Certificate to commence business or a business permit issued by the Registrar-General or a District Assembly

- to receive payment from the Controller and Accountant General or a District Assembly in respect of a contract for the supply of any goods or provision of any services

- to register for the Ghana Card with the National Identification Authority

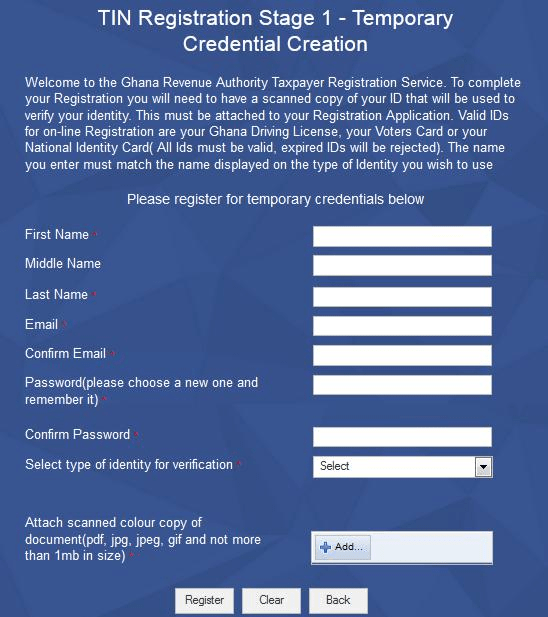

What you need to apply for your Tax Identification Number (TIN) online in Ghana

- First Name

- Last Name

- Working Email Address (not to be shared)

- Scanned colour copy of identity document (pdf, jpg, jpeg, gif and not more than 1mb in size) for verification. Valid IDs for on-line Registration are your Ghana Driving License, your Voters Card or your National Identity Card (All Ids must be valid, expired IDs will be rejected).

It’s interesting how a Ghanaian Passport is not part of the accepted documents for a TIN.

Steps to Register for Tax Identification Number (TIN) in Ghana

This Process covers Stage 1 of the TIN online application process.

Here is how to get TIN Number in Ghana:

- Visit the Ghana Revenue Authority portal by clicking here.

- Fill in your basic details and choose a password

- Click the “add” button to attach your ID (It should be a good quality, colour scanned copy of the above identity card (pdf, gif, jpeg format)

- After adding, click on upload

- Click register on the same page.

- Wait while the Request is submitted

- Check your email for confirmation to continue the process.

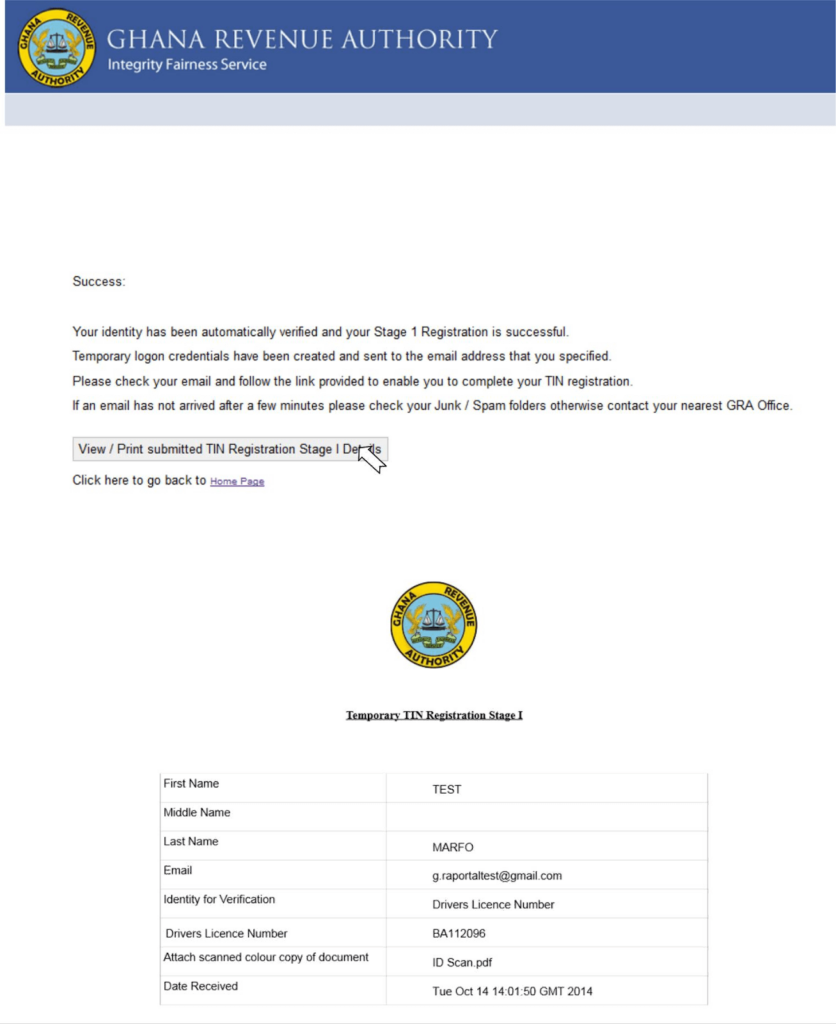

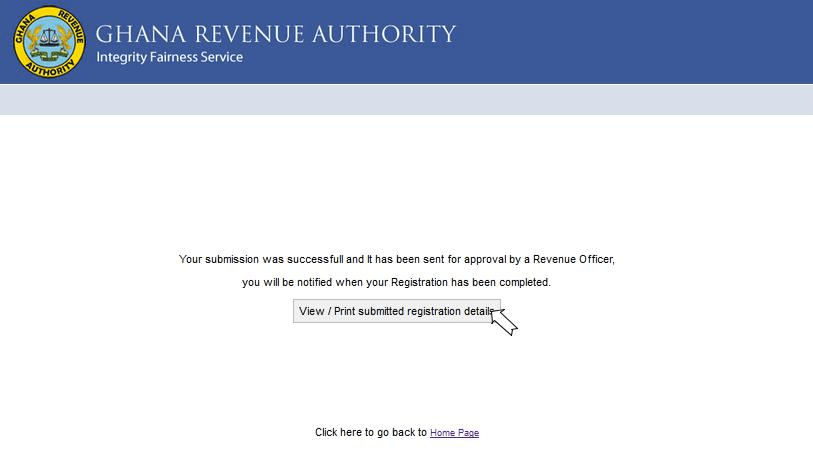

- Once the name, email and ID have been validated you will receive a Success Message. If you wish you may click on the button to view or print a copy of the submitted details

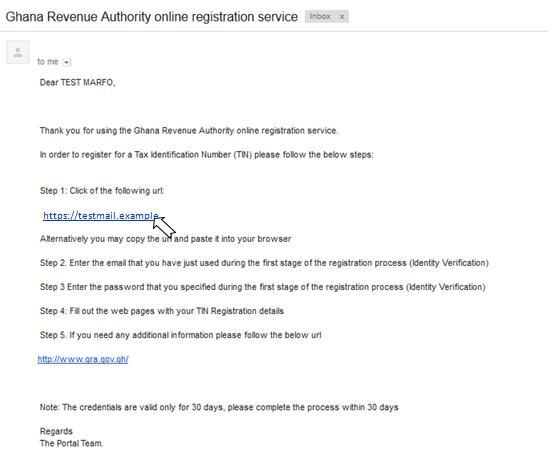

- Wait for the system generated email; this will provide information on the registration process. The email will include a link to follow to continue your TIN Registration

- Follow the URL contained in the email received

- Fill in the Email and Password (please note that these must be the ones that were registered earlier.

- Click Register to continue

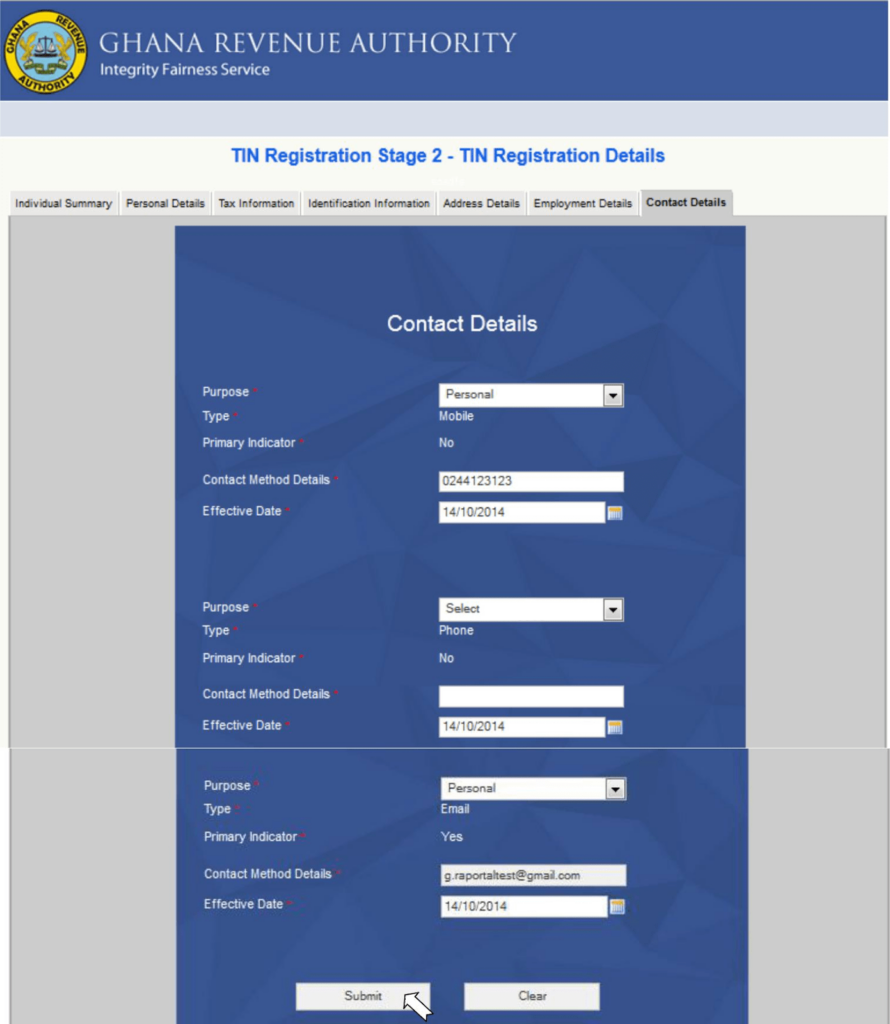

- You will proceed to the TIN Registration Details Pages. Fill out the various Tabs, at the end of each Tab click on “Save and Proceed”. The tabs include:

- Individual Summary

- Personal Details

- Tax information

- Identification Information

- Address Details

- Employment Details

- Contact Details

- After providing all the above, click SUBMIT.

- You will receive a success message like in the photograph below. Sit tight and wait for your TIN. It should take a day or two but not more than 14 days.

Note: If you have used an NIA Card (Ghana Card) then TIN registration is automatic and you will receive an email notification within a minute or so.

Other types of card require a GRA officer to vet your documentation before a TIN is issued. In all cases, your TIN Certificate must be picked up from your nearest GRA Office.

Alternatively, you can download a TIN form and either email your completed form to [email protected] or take it to your local Domestic Tax Revenue Division office in Ghana

Contact GRA

You can call the GRA on +233- (0) 302 904545 OR +233- (0) 302 904546 or send an email to [email protected]

I went through the process and everything went well but I’m facing a problem say “your ID card number has not been validated” please help me

Kindly visit your local GRA office for help.

Pls am from long village how can I get me tin number

Please I have gone through all the rightful process but I have not received my TIN yet and its been almost 3 weeks now

You can verify at the GRA office nearest to you.

Please this truly working when I try filling the form they keep asking me to enter my valid first name

The system seems to currently have a problem

Thanks for the info. What about for non-Ghanaians? What ID is accepted? Tried non-citizen but it wouldn’t accept

Kindly visit the GRA Office and you will be attended to.

Does the system accept NHIS or passport?

Neither of them

Please after submitting this is what i get “Error in message structure. Please ensure mandatory element Attachment is provided”. What should i do please.