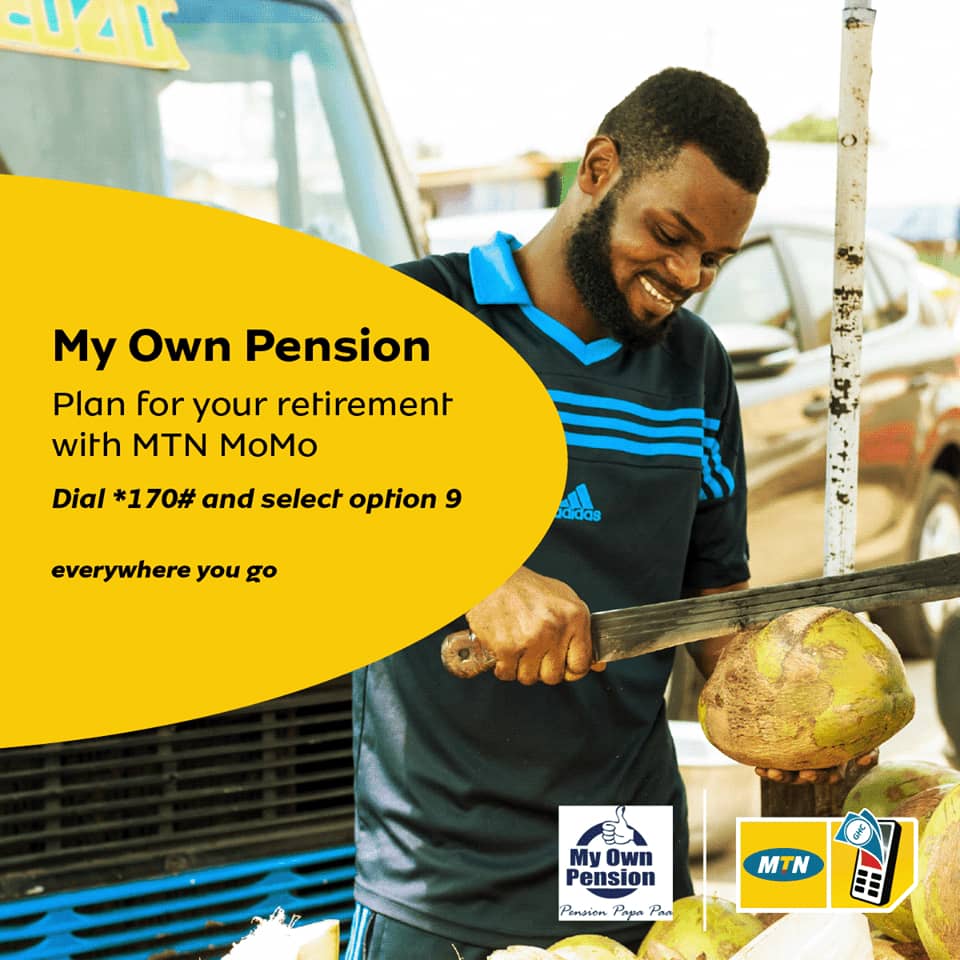

Close to 100,000 Ghanaians have subscribed to making personal pension contributions through MTN Mobile Money and United Pensions Trust’s personal pension scheme dubbed ‘My Own Pension’.

With over 80 per cent of Ghana’s labour force being in the informal sector, ‘My Own Pension’ which is a tier 3 mobile pension and savings product is expected to create an opportunity for more Ghanaians to have a structured pension system. ‘My Own Pension’ reiterates MTN Ghana’s commitment to engendering financial inclusion, social protection and the improvement of living standards for Ghanaians from all sectors and diverse economic backgrounds using technology. The service was launch in Accra in May in partnership with Fidelity Bank and Bora Capital Advisors.

Commenting on the progress made so far after the launch, Mr. Eli Hini, General Manager for MTN Ghana Mobile Financial Services said, “We are very satisfied with the response received so far from the public, and this tells us that we are gradually achieving success with our quest to drive financial inclusion in Ghana”. “As the leader in the Telecoms Market, we will continue to collaborate with like-minded organizations to make our customers lives a whole lot brighter” he added.

The Chairman for United Pensions Trustees, Mr Harold Awuah-Darko encouraged persons who are yet to sign onto the scheme to do so and enjoy the benefits it provides. He said, “The more you invest in your pension, the more money you would have working for you and as a result, you generate more returns.” Mr Awuah-Darko also commended MTN for sharing in their vision of making pensions available to everyone everywhere.

The intervention by MTN Ghana, United Pension Trustees and the key partners was also applauded by the Director General of Management Development and Productivity centre, Mr KwakuOdame- Takyi who spoke on behalf of the Minister for Labor Relations Mr Ignatius Baffuor Awuah at the launch. He said,“Government is very supportive of any initiative that aids in fulfilling the National Pensions Act, 2008(Act 766) and drives inclusivity for everyone especially those in the informal sector.”

‘My-Own Pension’ scheme is fast, easy and affordable and has optional products ranging from life, health and motor insurance which can be arranged for interested clients. Contribution to the scheme begins with as low as GHS 1 daily, GHS 5 weekly and GHS 20 monthly. There is also the option of doing voluntary payments where a contributor’s chosen contribution is automatically deducted at the end of the selected frequency through his/her MTN Mobile Money account. To subscribe to the service, MTN

Mobile Money subscribers will have to dial *170#, select Pension and Insurance, select MY OWN PENSION, and continue to follow the steps.

MTN Ghana is committed to providing its customers with a brighter life through innovative services that enable them to live a connected lifestyle.